The Power of Proven Profit Models

The vast majority of clients that engage our services are either in the pre-start up phase of their business journey or are struggling to transition from one phase of their business development to the next. In almost every instance, when you dig down deep enough, the question that they want us to help them answer is, "how can my small business consistently generate sustained, superior profits?". Every client comes at this question from a different angle and each has a different perception of what "superior" means for them, but they are all fundamentally feeling after the answer to the same question.

Much of what we help our clients do is to apply proven "profit models" to their individual businesses and unique circumstances. Notable students of profitability, such as Adrian Slywotzky, have identified numerous different ways in which businesses make profit happen. In his classic book, The Profit Zone - How Strategic Business Design Will Lead You to Tomorrow’s Profits, and in it's follow up, The Art of Profitability, Slywotzky identifies more than twenty profit models that a wide range of companies have used to create sustained, superior profits. Those of us who make an ongoing study of exceptional business performance can no doubt add a few more that have emerged in recent years. There are literally dozens of different ways in which businesses, across the spectrum of industries in which they operate and markets that they serve, have consistently generated superior profits. Here at Continuous Business Planning, we believe that understanding as wide a range of these as possible and applying those that might lend themselves best to your business is key in establishing a successful business.

Please understand that we do not mean slavishly copying your competitor's business model or industry "best practice". Just as you couldn't trace a copy of a Picasso and call yourself an artist, you also can never completely copy another company's business model or learn a formula that will automatically lead to profitability. However, we believe that a study of how businesses create and sustain profits, especially of those businesses that consistently create superior profits within their industry will equip any business owner with an understanding of the fundamental principles of profitability and prepare them for the difficult task of applying the right profit model to their individual business situation. By first identifying general principles of superior profitability that are relevant across a wide range of industries and markets and then applying those principles of profitability that fit best with your business and unique circumstances, we believe that your business can also achieve superior results.

As an illustration of what we mean by a "profit model", we will present three proven profit models for your consideration.

1. Customer Solutions Profit Model

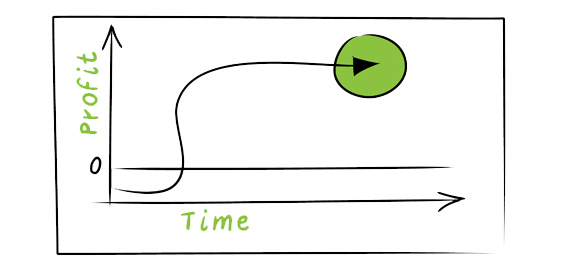

A business designed to exploit the Customer Solutions Profit Model will create a flow of information about the customer’s business that enables them to understand the customer’s economics and priorities better than anyone else does. It is a forward-looking approach because it goes beyond present needs, taking in the customer’s needs in the future. In terms of how the Customer Solutions Model translates into profitability, the following diagram illustrates the journey through an initial investment period toward superior, sustainable profits.

Companies that embrace this model eventually achieve extraordinary profits by initially investing heavily in capturing the voice of the customer so they can create products and services that meet both spoken and unspoken needs. For those seeking to apply the power of the Customer Solutions Profit Model to their business, it's distinguishing characteristics are as follows: Intimate knowledge of the customer and customization of products and services into integrated solutions that address the customer’s mission-critical problems in such a way that these solutions are woven into the daily fabric of the customer’s business operations. Once all five components of the Customer Solutions Profit Model have been locked in, it is very hard to compete against the incumbent, especially in slow-growing or small markets.

It is, however, important to recognize that customer needs and priorities are dynamic. Spotting shifts in priorities and needs and responding to them requires focusing on your processes to ensure they are always capable of fulfilling changing customer requirements. An organization commited to the Customer Solutions Profit Model that is capable of managing their business processes accordingly over time will achieve sustained, superior profits.

2. Time Based Profit Model

The time based profit model is rooted in the concept that time is a critical business performance variable and a powerful source of competitive advantage. Compressing time leads to sustained, superior profits because the following changes occur:

- Faster product development cycles and time to market

- Increased productivity

- Improved product or service quality

- Reduced costs

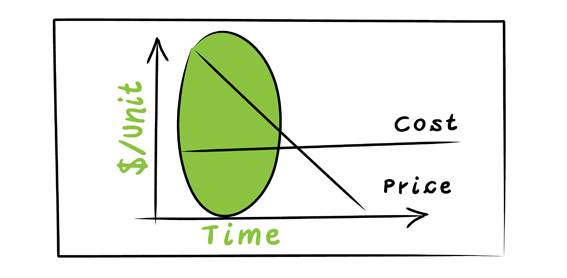

A good example of this approach is Intel. The source of their sustained, superior profits is their ability to stay two steps ahead of their competitors. By doing this, they are able to command higher prices for their memory chips. When they are first to market with a new product, profits happen in the first four or five quarters and then drop down very quickly to almost zero after that as the price is reduced as competition intensifies. To make a profit, Intel must work hard to maintain at least a two year lead over its competitors. Diffusing the product as quickly as possible is key to extending their period of profitability. This is illustrated in the diagram below.

Coming late to market, on the other hand, translates into lower profits over a products lifetime. High-tech products that come to market on time but over budget show a much higher return than products that arrive late within budget, according to a study by McKinsey. According to that same study, getting to market a month earlier improves profits an average 3.1%. Beating the competition by six months improves profits by nearly 12%. This McKinsey study, credited to Donald Reinertsen, also indicates that a six month late entry into the market place reduces life time profits by nearly 33%.

When you consider the alternatives to being first to market, this principle seems to be sound. In order to displace an entrenched competitor, it becomes necessary to provide potential customers with a product that's cheaper or better, preferably both. Whilst the actual numbers may vary by industry and product line, it is clear that sustained, superior profits are available to organizations that are capable of managing their business processes in line with the Time Based Profit Model.

3. Low Cost Profit Model

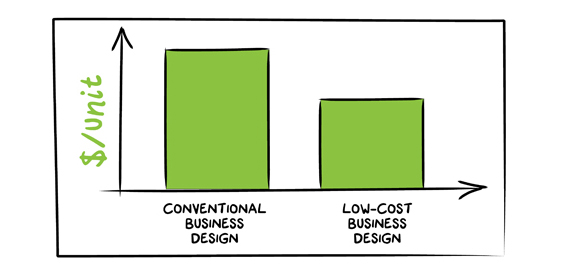

Creating a new low cost position within a particular industry through intelligent business design can create a significant advantage over a business with a more conventional business design, even a long established player that has established a cost advanatage in the industry through experience curve effects. This is illustrated in the follwing diagram.

The classic example in the UK is the emergence of the "no frills" airlines such as Ryanair and EasyJet which have thrived despite the dominance of the big traditional airlines such as British Airways and Virgin. They designed a low margin, high volume business model, along very similar lines to what Southwest Airlines had done in the US, that made sustained, attractive profits due to the pared down nature of their offering despite being significantly cheaper than the traditional airlines with whom they compete. For those of you interested in a thorough treatment of which elements of their business models distinguish a low cost airline from a traditional airline, then please click here.

Another example of the low cost profit model in action are the European "hard discount" supermarkets that have expanded so successfully in the UK over the course of the last decade, such as Lidl and Aldi. The growth of "hard discount " supermarkets has been truly remarkable. Aldi alone is expected to top $100 billion in sales by the end of 2013, and Lidl to reach that milestone the following year. The key to success was their adoption of a Low Cost Profit Model. "Hard discount" supermarkets, according to a fascinating article in the subject in the Harvard Business Review, are about one-tenth the size of a Wal-Mart, with comparably lower staffing levels, and are usually located in low-rent districts. Hard discounters have an extremely efficient supply chain, thanks largely to their limited SKU numbers and private-label focus, which make for a simpler operation. Taking Aldi for example,

- Aldi’s costs only add 13% or 14% to the procurement price—2% each for logistics, rental, overhead, and marketing, plus about 5% for staff. This remarkable efficiency allows Aldi to offer products at startlingly low prices. Indeed, most international comparisons of prices across retail stores have designated Aldi the winner

- Aldi's own brands account for at least half their offerings. In Aldi’s case the number exceeds 90% (at Wal-Mart it is 38%). Because these private labels are typically priced at 50% below manufacturers’ brands, their success has been disastrous for both traditional supermarkets and brand manufacturers.

It should be clear that sustained, superior profits are available to organizations that are capable of managing their business processes in line with the Low Cost Profit Model.

Now that you have read these, you will no doubt be curious to identify the other profit models. They are all around us and can be readily deduced by a keen student of profitability. The question is can you and your business tap into the power of applying proven profit models to your individual circumstances? If this has piqued your interest but you feel you might benefit from a nudge in the right direction, feel free to contact Continuous Business Planning today for a no obligation discussion of how a proven profit model might be applied to your business to create sustained, superior profit.